The building and public works (BTP) sector is very important for the economy of the Principality of Monaco, just as VAT is essential for its budget. The VAT regulations in the construction sector have changed a lot in the last few years and are very complex.We offer you a review of the main VAT and tax regulations applicable in the Principality in the construction sector.

What is a “BTP service” from a tax point of view?

The term “BTP” (Bâtiments et Travaux Publics) should be understood as the term “building”:

- Any building or structure fixed to or in the ground, above or below sea level, which cannot be readily dismantled or moved;

- Any element installed and forming an integral part of a building or construction without which the building or construction is incomplete (doors, windows, roofs, stairs, elevators …);

- Any equipment or machinery, permanently installed in a building or structure which cannot be moved without destruction or alteration of the building or structure.

The scope of the so-called “building-related services” is very broad. In addition to construction and renovation companies and the various trades involved as subcontractors, we can mention the services of an architect, a surveyor, video surveillance, security, the services of a landscaper, commissions on the sale of a building or advice on the sale of shares in a building.

Depending on the services performed or subcontracted, the VAT rules depend on three categories.

VAT rules and categories of services in the construction sector in Monaco

1 – Services attached to a building

This category, the broadest in its content, allows to determine the place of taxation of the services , which is the place of location of the building on which the services are performed.

- Example 1: a company established in Italy which carries out subcontracting services of masonry on a house located in Monaco carries out a taxable service in Monaco.

- Example 2: a company established in Great Britain which installs a video surveillance system in the Principality makes a taxable service in Monaco.

2 – Services on residential premises

This category allows to determine the VAT rate to be applied which can be the standard VAT rate of 20% or one of the two reduced rates of 10% and 5.5%.

- The reduced VAT rate of 5. 5% applies to energy improvement work on residential premises that have been completed for more than two years (Article 56 bis of Monaco’s Code des taxes sur le Chiffre d’Affaires).

- The reduced VAT rate of 10% applies to improvement, transformation, development and maintenance work on residential premises completed more than 2 years ago.

- The standard VAT rate of 20%, applicable in the Principality, concerns all services related to a building that do not fall within the scope of the two reduced rates.

3 – Subcontracting services

This category makes it possible to know who is the person liable to pay VAT to the tax authorities, the main contractor, his subcontractors or the final customer.

It involves three types of companies.

VAT & subcontracting in Monaco depending on the type of company:

1. Prime Contractor (or prime contractor):

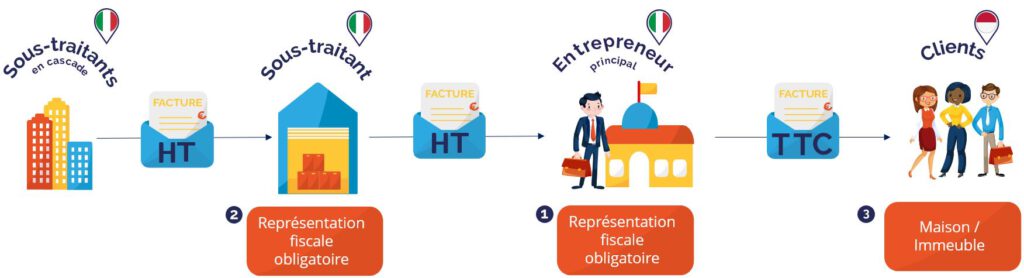

The main company established in the Principality of Monaco is liable for VAT on subcontracting purchases, whether the subcontractors are established in Monaco, in France or abroad. Thus, the rule is that subcontractors invoice the main contractor excluding VAT; it is up to the latter to self-assess the VAT in Monaco.

A main contractor established in a country other than the Principality of Monaco must therefore identify itself for VAT purposes in Monaco in order to pay VAT on subcontracting purchases.

This main contractor will also have to charge Monegasque VAT to his clients, whether they are identified for VAT in Monaco or not.

2. Subcontractors:

Please note: foreign subcontractors are required to register a VAT numberin Monaco in order to declare their subcontracting services, even if they are invoiced to the main company excluding VAT.

Subcontractors who themselves use subcontractors (cascade subcontracting) become liable for VAT in Monaco according to the VAT rules. Their VAT returns in Monaco will thus show two types of transactions: their sales of subcontracting services to the main company and their own subcontracting purchases.

3. The end customers (or project owner):

End customers, regardless of their status (identified for VAT or not identified for VAT in Monaco), must receive an invoice including Monegasque VAT from the main contractor.

In practice

Does your business need a VAT number in Monaco? Our partner MATHEZ MONACO, a subsidiary of the MATHEZ FREIGHT & COMPLIANCE group, answers all your needs for VAT tax representation in the construction sector in Monaco: click here.