How are purchases and deliveries of goods in dropshipping or triangular transactions taxed within the EU? What if the seller is established in a country other than the country of purchase and resale of the goods? What are the applicable VAT rules? Do you need to appoint a fiscal representative or tax advisor ?

A summary by the experts

In the context of Intra-Community trade, two scenarios occur frequently:

- Purchasing & reselling goods in the same Member State:

Purchase and resale transactions are taxable in that State, and in most cases the trader must register locally for VAT. - Purchase and resale in two different Member States:

Simplification measures allow traders established in a Member State other than the country of departure and arrival of the goods not to register for VAT purposes in that country and to buy and resell tax-free.

The following conditions must be met:- The trader must not be established or registered in the countries of departure or arrival.

- The consignee takes possession of the goods upon their arrival in his country.

- the recipient is registered and liable for VAT in his country.

- Purchase and resale operations cannot be carried out under the same conditions (departure conditions: EXW, FOB or FCA incoterm). This is one of the provisions of the “Quick Fixes” applied in 2020.

If any of these conditions are not met, the trader shall register for VAT in one and/or both of these countries.

The same conditions apply to a trader established in a third country; however, they will have to appoint a tax representative established in a Member State other than the departure or arrival State. - Then there’s a 3rd scenario. Purchase and resale operations involving one or more third countries (outside the European Union):

If a trader wants or has to take care of export formalities from the departure country, or import formalities in the arrival country, in most cases, they will need to register for VAT.

Typical transactions

The VAT regulations described here may apply to the following transactions:

- trade/purchase/resale operations, import/export

- Intra-Community supplies

- Triangular trade/triangular operations/quadrangular

- dropshipping– online sales without stock with direct delivery by the supplier.

Trading operations are extremely varied, and a number of scenarios will require registering for VAT or appointing of a fiscal representative in one of the countries concerned. Please contact us.

Examples of VAT transactions and obligations

Intra-Community triangular trade (as applied in Quick Fixes)

You are a trader established in France. You purchase goods from a vendor in Germany and sell them to a customer established and registered for VAT in Italy. The goods are delivered directly from Germany to Italy and your Italian end customer takes care of the transport (EXW incoterm – ex works).

> You must be registered for VAT in Italy, unless you are already registered for VAT in Germany. There are two possible scenarios:

In principle, you must register for VAT in Italy, in line with “Quick Fixes” regulations. The transactions will be qualified as follows:

![]()

Intra-Community acquisition subject to VAT in Italy.

You must provide your German supplier with your Italian VAT number. The purchase is considered an Intra-Community acquisition subject to Italian VAT – to be declared on your Italian VAT returns.

![]()

Domestic sales subject to VAT in Italy.

In the case of Italy, you will invoice your customer without VAT, as Italy has opted for the reverse charge system.

Your tax-free sale may not have to be declared on your Italian VAT returns.

Note: this system varies from country to country.

General rules and special cases:

There are two scenarios depending on the legislation in force in the country where the domestic sale is made:

- The general rule: you will have to invoice your customer including VAT (at the VAT rate in force in their country) and will file your VAT return in that country for all your operations (purchases and sales).

- The reverse charge mechanism)

Some Member States will apply the reverse charge mechanism to domestic deliveries made on their territory. In this scenario, it is the purchaser who will be liable for the VAT, not the seller. Depending on the country, this purchaser must have a VAT number and/or be established in the country where the delivery is made.

Please note: even if the country where you deliver has opted for the reverse charge mechanism, you will still have to register for VAT for Intra-Community acquisitions (transaction 1 above)!

If you are already registered for VAT in Germany you can use a different scheme

Transactions will be qualified as follows:

Domestic purchase of goods in Germany from a supplier in Germany:

If you buy the goods in Germany, you will be charged including German VAT at the current VAT rate in Germany for the item concerned. This input VAT can be deducted on the VAT returns that you have to file in Germany.

![]()

Sale of goods to a customer in Italy:

If your customer is registered for VAT in Italy, you are making an Intra-Community supply that is exempt from German VAT.

You will need to file a German VAT return, a German EC SALES LIST return and a German INTRASTAT return on dispatch if the threshold is exceeded. In addition, you will have to comply with the German obligations in terms of invoicing and proof of exemption.

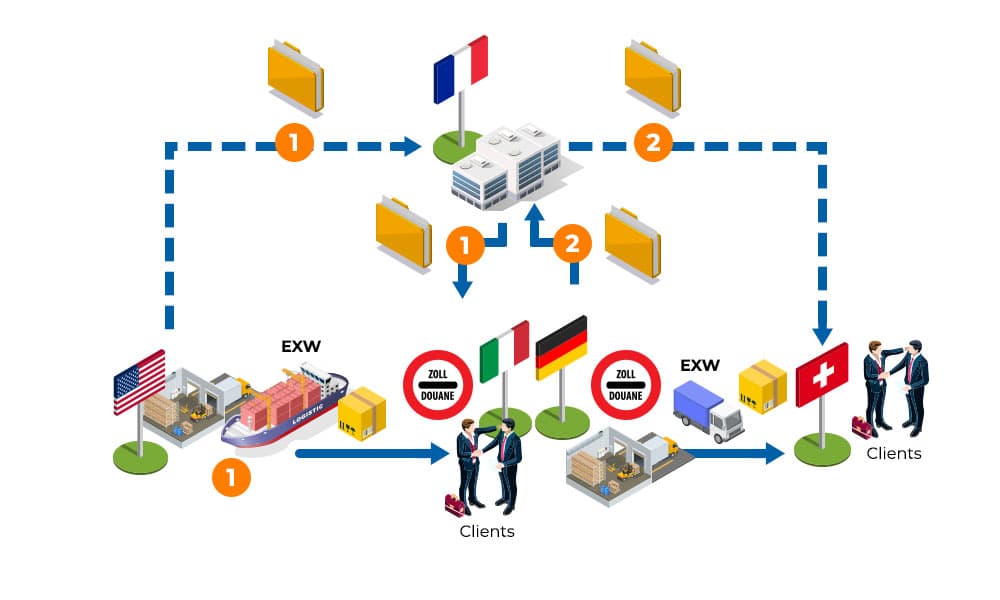

Trading operations involving a third country outside the European Union (dropshipping)

You are a trader established in France. You run trading operations involving a third country (outside the European Union).

![]()

Triangular import (USA > Italy)

When you are an importer in a Member State of the European Union (Italy), you must register for VAT in the arrival Member State (Italy).

![]()

Triangular export (Germany > Switzerland)

If you are acting as an exporter of records from an EU Member State, (Germany), you must register for VAT purposes in the departure Member State (Germany).

These examples are given to clarify VAT mechanisms and explain your obligations. It is worth checking the regulations for your particular transactions in line with the law, doctrine and practices in each of the EU member States. Contact us for more information!

Why use a

fiscal representative?

A tax advisor or tax representative will be able to help you in understand the local rules and identify the most suitable system with you, before handling your VAT registration and managing your obligations in the country(ies) where you carry out your trading operations.

A simple, reliable and efficient solution for all your VAT obligations in all EU Member States and some non EU countries

Tell us about your operations, and we will help you determine the best way to manage your obligations

European regulatory references

Deliveries of goods without transport

Article 31

Where goods are not dispatched or transported, the place of supply shall be deemed to be the place where the goods are located at the time when the supply takes place.

Supply of goods with transport

Article 32

Where goods are dispatched or transported by the supplier, or by the customer, or by a third person, the place of supply shall be deemed to be the place where the goods are located at the time when dispatch or transport of the goods to the customer begins.

However, if dispatch or transport of the goods begins in a third territory or third country, both the place of supply by the importer designated or recognised under Article 201 as liable for payment of VAT and the place of any subsequent supply shall be deemed to be within the Member State of importation of the goods.

Place of an Intra-Community acquisitions of goods

Article 40

The place of an Intra-Community acquisition of goods shall be deemed to be the place where dispatch or transport of the goods to the person acquiring them ends.

Article 41

Without prejudice to Article 40, the place of an intra-Community acquisition of goods as referred to in Article 2(1)(b)(i) shall be deemed to be within the territory of the Member State which issued the VAT identification number under which the person acquiring the goods made the acquisition, unless the person acquiring the goods establishes that VAT has been applied to that acquisition in accordance with Article 40.

If VAT is applied to the acquisition in accordance with the first paragraph and subsequently applied, pursuant to Article 40, to the acquisition in the Member State in which dispatch or transport of the goods ends, the taxable amount shall be reduced accordingly in the Member State which issued the VAT identification number under which the person acquiring the goods made the acquisition.

Place of importation of goods

Article 60

The place of importation of goods shall be the Member State within whose territory the goods are located when they enter the Community.

Article 61

By way of derogation from Article 60, where, on entry into the Community, goods which are not in free circulation are placed under one of the arrangements or situations referred to in Article 156, or under temporary importation arrangements with total exemption from import duty, or under external transit arrangements, the place of importation of such goods shall be the Member State within whose territory the goods cease to be covered by those arrangements or situations.

Similarly, where, on entry into the Community, goods which are in free circulation are placed under one of the arrangements or situations referred to in Articles 276 and 277, the place of importation shall be the Member State within whose territory the goods cease to be covered by those arrangements or situations.

Sources: Articles 31, 32, 40, 41, 60, 61 of Directive 2006/112/EC

The place of an Intra-Community acquisition of goods shall be deemed to be the place where dispatch or transport of the goods to the person acquiring them ends.

Source: Article 40 of Directive 2006/112/EC

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.