Bringing together the VAT experts of the MATHEZ FREIGHT & COMPLIANCE group, EASYTAX was created to offer companies that are developing internationally a complete support in terms of VAT compliance.

Who are we?

Company & group

Created in 2000, EASYTAXis an accredited VAT tax representative for companies in various sectors of activity – e-commerce, events, yachting, construction, logistics, trade…

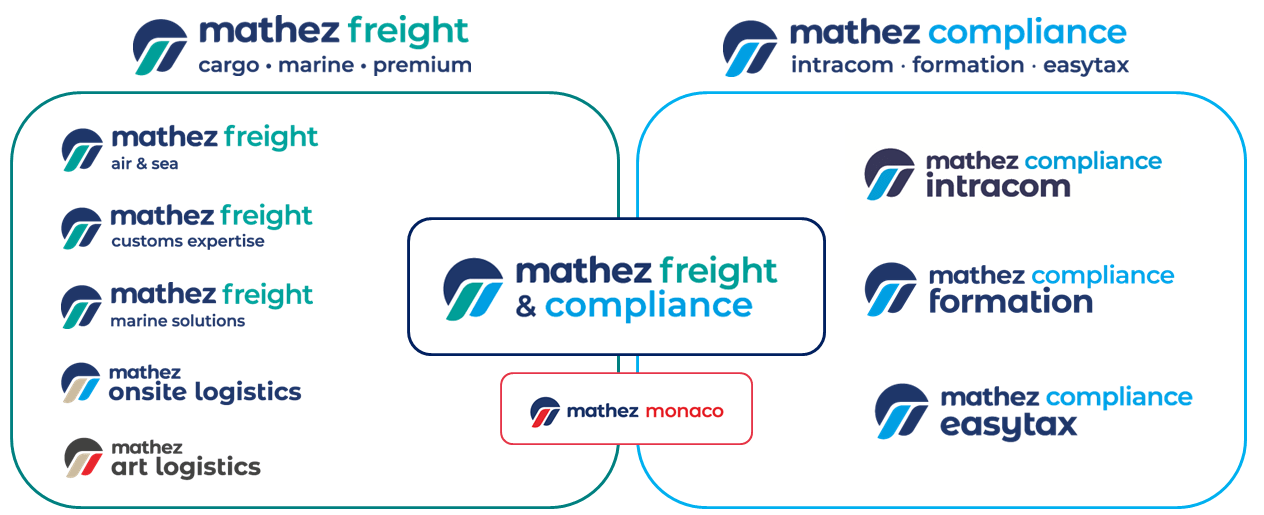

This division has been developed within the group MATHEZ FREIGHT & COMPLIANCEwhose historical company, MATHEZ FREIGHT,is a freight forwarder and customs representative since 1950. The group’s regulatory competence center, MATHEZ COMPLIANCE, gathers VAT experts around training activities (MATHEZ FORMATION), tax representation (EASYTAX), and the 1st EMEBI (ex-DEB), DES & Intrastat processing center in France(MATHEZ INTRACOM).

Today, the group employs over 210 people in 17 offices in France and Monaco. We are a founding member of the No. 1 network of independent agents worldwide, , with sales of 48 million euros in 2023.

date of creation of the family group

employees spread over

17 offices

m€ of turnover

SA with a capital of €373,500.

Mission

EASYTAX provides companies – SMEs or multinationals expanding internationally – with dedicated VAT expertise and outsourced management services to fulfil their VAT obligations in a simple, secure and efficient manner throughout the European Union and beyond.

Values

Meticulous

We are committed to our role as tax experts and are extremely rigorous in everything we do.

Exacting

We are dedicated to advising you on the best mechanisms, and to carefully monitoring every file you entrust to us.

Familiar

You are accompanied by a dedicated, experienced consultant, skilled in all your operations and countries of intervention, who you can contact directly.

Integrity

We value our clients, business partners and institutions, and work in compliance with national and international obligations.

Benefits

Why work with us?

- You’ll have a single partner, competent in all countries.

- Because you appreciate being supported by an experienced consultant who provides you directly with tailor-made, operational advice.

- To benefit from a complete VAT compliance service, from registration to the filing of returns.

- For the comfort and security of real expertise backed by international regulatory monitoring.

- Because we value your requirements: deadlines, simplicity, practicality, cost control.

Our team

Made up of multilingual consultants with more than 10 years of experience in the VAT field, our team benefits from the group’s expert, commercial and support services.

Nicolas D’Asta

Chairman of the Executive BoardTrainer, consultant and expert on French and international VAT issues, Nicolas manages the VAT competence centre grouping together EASYTAX, MATHEZ FORMATION, and MATHEZ INTRACOM.

Karine Dhalluin

Account Manager - Team LeaderKarine manages the team in charge of client portfolios and VAT obligations. She also has a portfolio of clients and analyses complex VAT transactions.

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.