How is passenger transport in one or several EU Member States taxed? What are the VAT rules for renting a mode of transport (cars, boats, etc.)? What is the VAT rate for passenger transport? When should you appoint a fiscal representative or tax advisor?

A summary by the experts

Both passenger transport services and renting modes of transport are subject to VAT within the European Union, but follow different rules:

1> Passenger transport services within the European Union are subject to VAT in each country according to the distances covered. This rule applies to road transport. Air and sea transport from and to foreign countries is in most cases exempt from VAT. As the regulations for these types of transport are rather complex, we suggest you contact an expert.

2> When a mode of transport is rented for a short period of time VAT is due at the place where the transport is provided. The place of provision is understood to be the place where the hirer takes possession of the transport or the place where a third party takes possession of the transport on behalf of the hirer. “Short term” means less than 30 days for a road or air transport, less than 90 days for sea transport.

![]() The service must be correctly qualified to determine the applicable rules. This qualification can be complex in some cases, such as for car rental with a driver or yacht rental with a crew.

The service must be correctly qualified to determine the applicable rules. This qualification can be complex in some cases, such as for car rental with a driver or yacht rental with a crew.

Examples of transport services & VAT obligations

2 – Renting means of transport

![]()

Transporting people

The price of the ticket must be divided in proportion to the distances travelled in each of the countries, and subject to Spanish, Italian and French VAT.

![]()

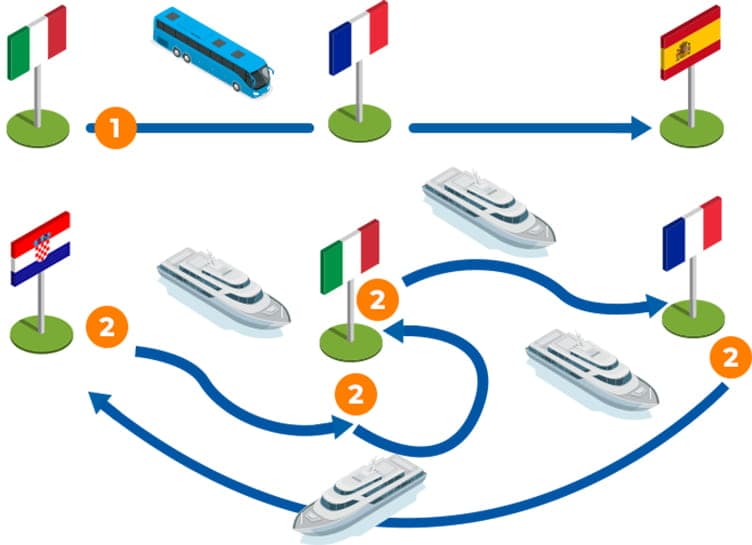

Renting a means of transport

You are a company that owns yachts and you carry out week-long charters with availability in Croatia, Italy and France.

This activity is subject to the VAT rules relating to the rental of short-term means of transport.

These examples are given to clarify VAT mechanisms and explain your obligations. It is worth checking the regulations for your particular transactions in line with the law, doctrine and practices in each of the EU member States. Contact us for more information!

Why use a

fiscal representative?

A tax advisor or a fiscal representative can help you understand the local rules clearly, register for VAT andmanage your obligations in the country where you carry out your transport service, or provide a mode fof transport.

Fiscal

representation

A simple, reliable and efficient solution for all your VAT obligations in all EU Member States and some non EU countries

Contact

an expert

Tell us about your situation, and we will help you determine the best way to manage your obligations

Examples of transport services

The place of supply of passenger transport shall be the place where the transport takes place, proportionate to the distances covered.

Source: Article 46 of Directive 2006/112/EC

The place of short-term hiring of a means of transport shall be the place where the means of transport is actually put at the disposal of the customer.

Source: Article 56 of Directive 2006/112/EC

1. Member States shall take the measures necessary to ensure that the following persons are identified by means of an individual number:

(a) every taxable person, with the exception of those referred to in Article 9(2), who within their respective territory carries out supplies of goods or services in respect of which VAT is deductible, other than supplies of goods or services in respect of which VAT is payable solely by the customer or the person for whom the goods or services are intended, in accordance with Articles 194 to 197 and Article 199;

(b) every taxable person, or non-taxable legal person, who makes intra-Community acquisitions of goods subject to VAT pursuant to Article 2(1)(b) and every taxable person, or non-taxable legal person, who exercises the option under Article 3(3) of making their intra-Community acquisitions subject to VAT;

(c) every taxable person who, within their respective territory, makes intra-Community acquisitions of goods for the purposes of transactions which relate to the activities referred to in the second subparagraph of Article 9(1) and which are carried out outside that territory.

(d) every taxable person who within their respective territory receives services for which he is liable to pay VAT pursuant to Article 196;

(e) any taxable person who is established within their respective territories and who, within the territory of another Member State, supplies services for which only the customer is liable to pay VAT pursuant to Article 196.

2. Member States need not identify certain taxable persons who carry out transactions on an occasional basis, as referred to in Article 12.

Source: Article 214 of Directive 2006/112/EC.

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.