How are supplies of goods after assembly or installation taxed within the European Union? What are the applicable VAT rules? Do you need to appoint a fiscal representative or tax advisor ?

A summary by the experts

In the case of a delivery of goods with assembly or installation in another EU Member State, VAT is due at the place of assembly on the entire sales contract (goods & services).

As a supplier, you are, as a general rule (see below), the person liable for VAT and must therefore be registered for VAT in the Member State where assembly is carried out.

The acquisition of certain goods or components abroad will, where appropriate, also have VAT implications.

Examples of VAT transactions and obligations

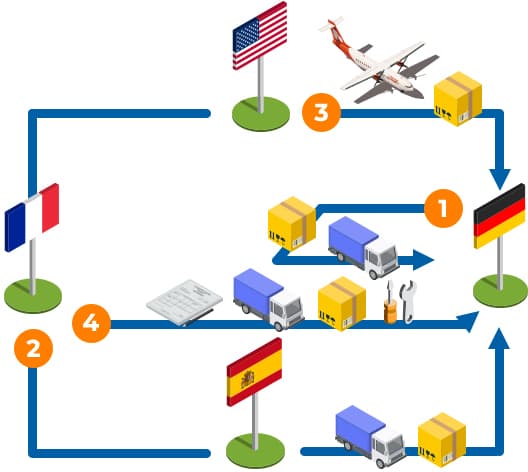

Domestic purchase:

For purchasing supplies in Germany, you will be invoiced with German VAT included. This VAT can be deductedon the VAT returns that you have to file in Germany.

In order to claim the VAT refund in Germany, you must be registered for VAT in Germany, except in the following cases:

- the sale is subject to the reverse charge mechanism

- you are not making an Intra-Community acquisition or import.

Intra-Community acquisition:

If you make a purchase from a Spanish supplier, for example, you will be liable for VAT in Germany on that purchase. You will need to register for VAT in Germany and give your German VAT number to your Spanish supplier. If you exceed the German Intrastat threshold, you will also need to file an Intrastat return with the German authorities.

Importation:

If you import from an American supplier, for example, VAT is due in Germany and must be paid to the German customs authorities. This VAT can be deducted on your German VAT returns.

Sale of goods with installation:

In the case of Germany, you will invoice your customer including German VAT. You will declare all your transactions (purchases and sales) on your German VAT returns. This is indeed the general rule in Germany.

General rule and specific schemes:

There are two scenarios according to the legislation in force in the country where the assembly is carried out:

- The general rule: you invoice your customer including VAT (at the VAT rate in force in their country) and file your VAT return in that country for all your operations (purchases and sales).

- The reverse charge mechanism: Some Member States will apply the reverse charge mechanism to the supply of goods with assembly carried out on their territory. In this case, it is the purchaser who will be liable for the VAT, and not the seller. Depending on the country, this purchaser must be registered for VAT and/or established in the country where the assembly is carried out.

Please note: even if the country where you are carrying out the assembly has opted for the reverse charge mechanism, you will still have to register for VAT for Intra-Community acquisitions and imports (transactions 2 and 3 above).

These examples are given to clarify VAT mechanisms and explain your obligations. It is worth checking the regulations for your particular transactions in line with the law, doctrine and practices in each of the EU member States. Contact us for more information!

Why use a

fiscal representative?

An tax advisor or a fiscal representative can help you understand the local rules clearly, register for VAT on your behalf and manage your obligations in the country where you carry out your delivery with assembly.

A simple, reliable and efficient solution for all your VAT obligations in all EU Member States and some non EU countries

Tell us about your situation, and we will help you determine the best way to manage your obligations

European regulatory references

“Where goods dispatched or transported by the supplier, by the customer or by a third person are installed or assembled, with or without a trial run, by or on behalf of the supplier, the place of supply shall be deemed to be the place where the goods are installed or assembled. Where the installation or assembly is carried out in a Member State other than that of the supplier, the Member State within the territory of which the installation or assembly is carried out shall take the measures necessary to ensure that there is no double taxation in that Member State.” Source: Article 36 of Directive 2006/112/EC

1. Member States shall take the measures necessary to ensure that the following persons are identified by means of an individual number:

(a) every taxable person, with the exception of those referred to in Article 9(2), who within their respective territory carries out supplies of goods or services in respect of which VAT is deductible, other than supplies of goods or services in respect of which VAT is payable solely by the customer or the person for whom the goods or services are intended, in accordance with Articles 194 to 197 and Article 199;

(b) every taxable person, or non-taxable legal person, who makes intra-Community acquisitions of goods subject to VAT pursuant to Article 2(1)(b) and every taxable person, or non-taxable legal person, who exercises the option under Article 3(3) of making their intra-Community acquisitions subject to VAT;

(c) every taxable person who, within their respective territory, makes intra-Community acquisitions of goods for the purposes of transactions which relate to the activities referred to in the second subparagraph of Article 9(1) and which are carried out outside that territory.

(d) every taxable person who within their respective territory receives services for which he is liable to pay VAT pursuant to Article 196;

(e) any taxable person who is established within their respective territories and who, within the territory of another Member State, supplies services for which only the customer is liable to pay VAT pursuant to Article 196.

2. Member States need not identify certain taxable persons who carry out transactions on an occasional basis, as referred to in Article 12.

Source: Article 214 of Directive 2006/112/EC

The place of an Intra-Community acquisition of goods shall be deemed to be the place where dispatch or transport of the goods to the person acquiring them ends.

Source – Article 40 of Directive 2006/112/EC

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.