How are admission fees for organised events within the European Union taxed? What are the applicable VAT rules? Do you need to appoint a tax representative to ensure your VAT compliance?

A summary by the experts

The rule here is that VAT is due at the place where the event happens.

The organiser will therefore have to apply the current VAT rate in the State concerned to the admission fees they collect, and register for VAT in order to declare and pay this VAT within that State.

Typical transactions

The above rule applies to VAT on ticketing, admission and registration fees for all types of events:

- VAT on shows, concertsand all cultural and artistic events and entertainment.

- VAT related to congresses, conferences, seminars.

- VAT on sports events (competitions, matches),

- VAT on training services open to several customers.

- VAT and ticketing/entrance fees/access fees.

Examples of ticketing-related VAT obligations

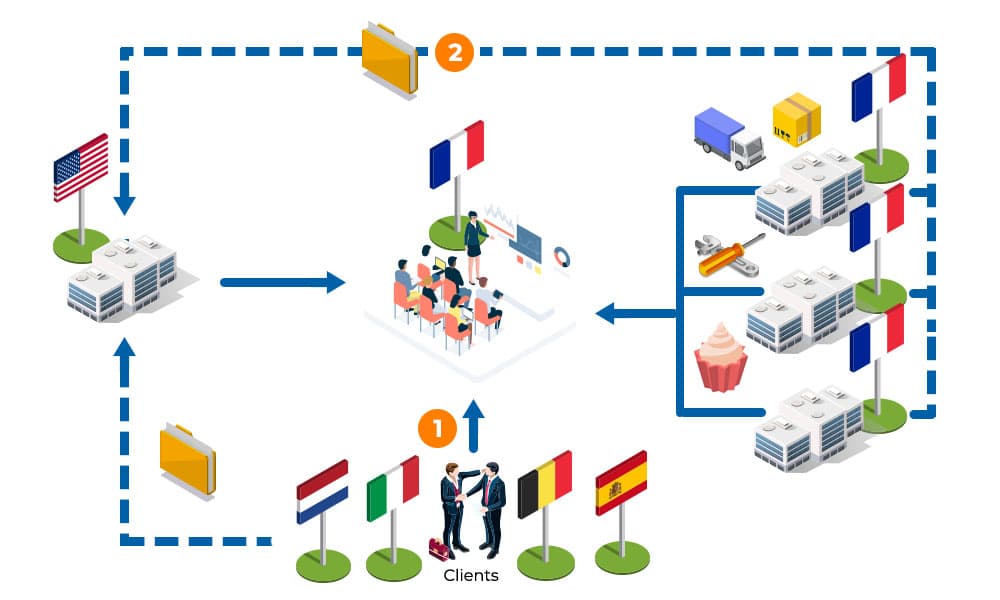

You are an American scientific conference organiser and are hosting a conference in France. Your customers are established pharmaceutical companies from all over the world.

![]()

Collecting entrance fees (in France)

You charge your customers a fee to enter the event and attend the various lectures given by scientists.

You are then required to register for VAT in France.

You must pay VAT in France on these entrance fees, whether you collect the amounts directly or whether you use a specialist service provider (PCO or “Professional Congress Organiser”).

![]()

Domestic purchases (in France)

If you have not used a PCO ( Professional Congress Organiser), you will probably purchase various products and services (hiring a congress centre, renting conference rooms, catering, hotel, bus, services etc.). These purchases are subject to French VAT. The VAT you have paid on your purchases can be deducted on the VAT returns you file in France.

These examples are given to clarify VAT mechanisms and explain your obligations. It is worth checking the regulations for your particular transactions in line with the law, doctrine and practices in each of the EU member States. Contact us for more information!

Why use a

fiscal representative?

A tax advisor or fiscal representative can help you understand the local rules clearly, register for VAT on your beahlf and manage your obligations in the country where your event takes place.

A simple, reliable and efficient solution for all your VAT obligations in all EU Member States and some non EU countries

Tell us about your situation, and we will help you determine the best way to manage your obligations

European regulatory references

The place of supply of services in respect of admission to cultural, artistic, sporting, scientific, educational, entertainment or similar events, such as fairs and exhibitions, and of ancillary services related to the admission, supplied to a taxable person, shall be the place where those events actually take place

Source: Article 53 of the Directive 2006/112/EC

1. Member States shall take the measures necessary to ensure that the following persons are identified by means of an individual number:

(a) every taxable person, with the exception of those referred to in Article 9(2), who within their respective territory carries out supplies of goods or services in respect of which VAT is deductible, other than supplies of goods or services in respect of which VAT is payable solely by the customer or the person for whom the goods or services are intended, in accordance with Articles 194 to 197 and Article 199;

(b) every taxable person, or non-taxable legal person, who makes intra-Community acquisitions of goods subject to VAT pursuant to Article 2(1)(b) and every taxable person, or non-taxable legal person, who exercises the option under Article 3(3) of making their intra-Community acquisitions subject to VAT;

(c) every taxable person who, within their respective territory, makes intra-Community acquisitions of goods for the purposes of transactions which relate to the activities referred to in the second subparagraph of Article 9(1) and which are carried out outside that territory.

(d) every taxable person who within their respective territory receives services for which he is liable to pay VAT pursuant to Article 196;

(e) any taxable person who is established within their respective territories and who, within the territory of another Member State, supplies services for which only the customer is liable to pay VAT pursuant to Article 196.

2. Member States need not identify certain taxable persons who carry out transactions on an occasional basis, as referred to in Article 12.

Source: Article 214 of Directive 2006/112/EC

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.