What are the VAT regulations for distance selling in the EU? Where and how do you register for VAT when selling online or on marketplaces? How are supplies of goods taxed when the purchaser, established in another EU Member State, is an individual or a company not registered for VAT? When is it necessary to appoint a fiscal representative or tax advisor?

A summary by the experts

The place of supply for EU Intra-Community distance selling depends on the net turnover achieved by the seller. The VAT regime for e-commerce has been reformed and the updated legislation came into force on 1st July 2021:

- From now on,when the total amount of Intra-Community distance sales is less than EUR 10,000, VAT is due in the seller’s Member State (the seller’s country of residence or the country where the goods are stored within the European Union, depending on the scenario).

- However, when the total turnover of distance sales is over EUR 10,000, VAT is payable in the purchaser’s Member State.

The seller can declare VAT either via the new One-stop-shop (OSS) or via a local VAT registration and return, which can be carried out by his fiscal representative or tax agent.

Typical transactions

The distance selling VAT scheme applies to all transactions in Europe commonly known as:

- online sales, internet sales, e-commerce, online trade

- distance selling, mail order

- sales via a marketplace,

- dropshipping – online sales without stock with direct delivery by the supplier.

VAT REFORM e-COMMERCE 2021

The European Directive on 5th December 2017, known as the“VAT e-commerce package“, came into force on 1st July 2021. It modifies the Intra-Community VAT thresholds mechanism and creates new One Stop Shops.

Until July 1st, 2021:

- Where the value of distance sales made in a destination Member State is below the threshold for that country (EUR 35 000 or EUR 100 000), VAT is payable in the seller’s Member State.

- Where the value of distance sales made in the destination Member State exceeds the threshold for that country (EUR 35 000 or EUR 100 000), VAT is payable in the purchaser’s Member State.

- Online traders had to register for VAT in the destination Member State as soon as the threshold was breached!

- This scheme did not apply to products subject to excise duty (alcohol, tobacco, mineral oils), to new means of transport or to goods subject to the VAT margin scheme (second-hand goods, works of art, etc.).

- When the total amount of Intra-Community distance sales is less than EUR 10,000, VAT is due in the seller’s Member State (the seller’s country of residence or the country where the goods are stored within the European Union, as the case may be).

- Where the total value of Intra-Community distance sales exceeds EUR 10 000, VAT is payable in the purchaser’s Member State.

- The seller can declare VAT either via the new One-Stop-Shop or via a local VAT registration and return, which can be carried out by their fiscal representative or tax advisor.

- The Intra-Community distance selling scheme applies to products subject to excise duty (alcohol, tobacco, oil) but this scheme does not apply to new means of transport or to goods subject to the VAT margin scheme (second-hand goods, works of art, etc.).

- However, the regime for the distance selling of imported goods with a consignment value lower than EUR 150 created by the reform that came into force on 1st July 2021 does not apply to products subject to excise duty (alcohol, tobacco, oil), new means of transport and goods subject to the VAT margin scheme (second-hand goods, works of art, etc.).

> See the September 2020 explanatory note on the One-Stop-Shop and the Practical Guide to VAT OSS published by the European Commission.

Examples of VAT transactions and obligations

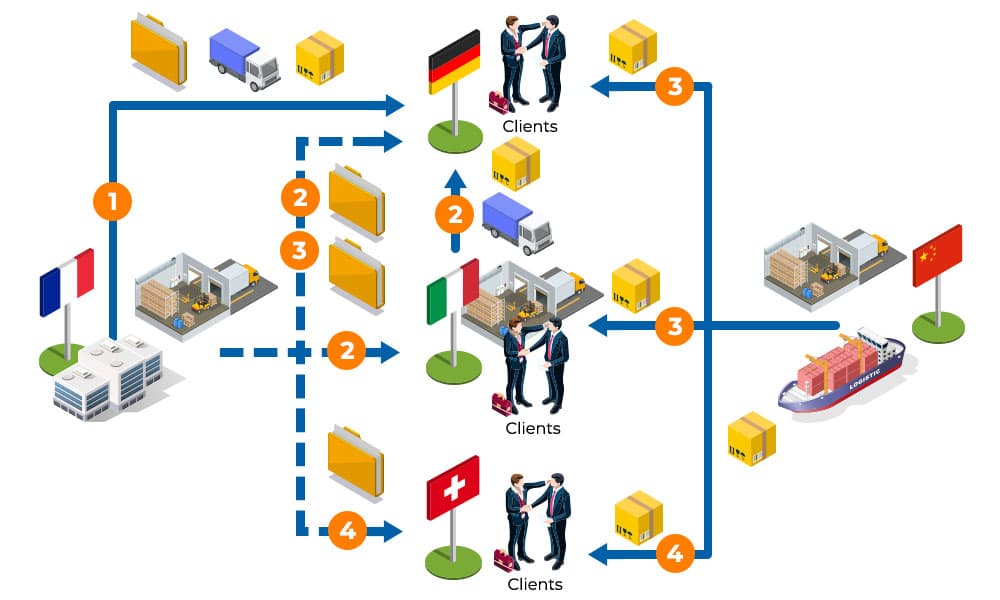

You are an online retailer based in France. You sell goods from France, Italy and China, and deliver them to end consumers in Germany, Italy and Switzerland.

![]()

Simple Intra-Community Distance Selling (IDS)

You deliver to private individuals in Germany from your warehouse in France, where you are based. 2 scenarios:

- Your turnover excluding VAT from Intra-Community distance selling during the year N-1 or N is less than the EUR 10,000 threshold: you invoice including VAT (French VAT).

- Your turnover excluding VAT from Intra-Community distance selling during the year N-1 or N is higher than the EUR 10,000 threshold: you invoice including VAT (German VAT).

To declare and pay back the German VAT collected you have two options:

- Register with the One-Stop-Shop in your country of residence (France), declare and pay VAT via the EU OSS portal.

- Register for VAT in Germany and file a German VAT return.

![]()

Intra-Community distance selling with remote stock

You deliver to private individuals in Germany from your warehouse in Italy. 2 scenarios:

- Your turnover excluding VAT from Intra-Community distance selling during the year N-1 or N is less than the EUR 10,000 threshold: you invoice including VAT (Italian VAT).

- Your turnover excluding VAT from Intra-Community distance selling during the year N-1 or N is higher than the EUR 10,000 threshold: you invoice including VAT (German VAT).

- Register with the One-Stop Shopfrom your country of residence (France) and declare your Intra-Community distance sales from the EU OSS portal. Please note: you must be registered in the country where you hold your stock (Italy) if you make domestic purchases/sales, Intra-Community acquisitions, imports or stock transfers from your stock.

- Obtain a VAT numberin Italy and Germany and file your returns locally.

![]()

Distance selling by dropshipping to customers in EU countries

You buy in China and deliver directly to your customers in Germany or Italy without going through a storage platform: this is called dropshipping.

For direct deliveries from China to your private customers in Germany and Italy, two scenarios are possible:

- Imported goods with a consignment value lower than EUR 150 per parcel: you can register with the one-stop-shop and declare these transactions through your IOSS portal. If your transactions are carried out through a marketplace , these transactions must be declared through the marketplace‘s one-stop shop (IOSS portal).

- Imported goods with a consignment value higher than 150 euros per package: you must identify yourself for VAT in the countries where the goods are imported (Germany and Italy) and complete the customs and VAT formalities.

![]()

Distance selling by dropshipping to customers located in a country outside the European Union

For direct deliveries from China to your private individuals in Switzerland, you will probably have to take care of the customs formalities on import. To pay local taxes and duties you will have to register for VAT in Switzerland.

Why use a

fiscal representative?

A tax advisor or fiscal representative will be able to recommend the most suitable system according to the VAT regulations in force, and will take care of your VAT registration and filing of your VAT returns in the country(ies) in which you carry out distance selling.

A simple, reliable and efficient solution for all your VAT obligations in all EU Member States and some non EU countries

Tell us about your situation, and we will help you determine the best way to manage your obligations

European regulatory references - distance selling

Article 32:

Where goods are dispatched or transported by the supplier, or by the customer, or by a third person, the place of supply shall be deemed to be the place where the goods are located at the time when dispatch or transport of the goods to the customer begins.

However, if dispatch or transport of the goods begins in a third territory or third country, both the place of supply by the importer designated or recognised under Article 201 as liable for payment of VAT and the place of any subsequent supply shall be deemed to be within the Member State of importation of the goods.

Article 33

By way of derogation from Article 32, the place of supply of goods dispatched or transported by or on behalf of the supplier from a Member State other than that in which dispatch or transport of the goods ends shall be deemed to be the place where the goods are located at the time when dispatch or transport of the goods to the customer ends, where the following conditions are met:

(a) the supply of goods is carried out for a taxable person, or a non-taxable legal person, whose intra-Community acquisitions of goods are not subject to VAT pursuant to Article 3(1) or for any other non-taxable person;

(b) the goods supplied are neither new means of transport nor goods supplied after assembly or installation, with or without a trial run, by or on behalf of the supplier.

2.Where the goods supplied are dispatched or transported from a third territory or a third country and imported by the supplier into a Member State other than that in which dispatch or transport of the goods to the customer ends, they shall be regarded as having been dispatched or transported from the Member State of importation.

Article 34

1. Provided the following conditions are met, Article 33 shall not apply to supplies of goods all of which are dispatched or transported to the same Member State, where that Member State is the Member State in which dispatch or transport of the goods ends:

(a) the goods supplied are not products subject to excise duty;

(b) the total value, exclusive of VAT, of such supplies effected under the conditions laid down in Article 33 within that Member State does not in any one calendar year exceed EUR 100 000 or the equivalent in national currency;

(c) the total value, exclusive of VAT, of the supplies of goods, other than products subject to excise duty, effected under the conditions laid down in Article 33 within that Member State did not in the previous calendar year exceed EUR 100 000 or the equivalent in national currency.

2. The Member State within the territory of which the goods are located at the time when their dispatch or transport to the customer ends may limit the threshold referred to in paragraph 1 to EUR 35 000 or the equivalent in national currency, where that Member State fears that the threshold of EUR 100 000 might cause serious distortion of competition.

Member States exercising the option referred to in the first subparagraph shall take the necessary measures to inform the competent public authorities of the Member State from which the goods are dispatched or transported.

3. The Commission shall present to the Council at the earliest opportunity a report on the operation of the special EUR 35 000 threshold referred to in paragraph 2, accompanied, if necessary, by appropriate proposals.

4. The Member State within the territory of which the goods are located at the time when their dispatch or transport begins shall grant those taxable persons who carry out supplies of goods eligible under paragraph 1 the right to opt for the place of supply to be determined in accordance with Article 33.

The Member States concerned shall lay down the detailed rules governing the exercise of the option referred to in the first subparagraph, which shall in any event cover two calendar years.

Article 35

Articles 33 and 34 shall not apply to supplies of second-hand goods, works of art, collectors’ items or antiques, as defined in points (1) to (4) of Article 311(1), nor to supplies of second-hand means of transport, as defined in Article 327(3), subject to VAT in accordance with the relevant special arrangements.

Sources: Articles 32, 33, 34 and 35 of Directive 2006/112/EC

1. Member States shall take the measures necessary to ensure that the following persons are identified by means of an individual number:

(a) every taxable person, with the exception of those referred to in Article 9(2), who within their respective territory carries out supplies of goods or services in respect of which VAT is deductible, other than supplies of goods or services in respect of which VAT is payable solely by the customer or the person for whom the goods or services are intended, in accordance with Articles 194 to 197 and Article 199;

(b) every taxable person, or non-taxable legal person, who makes intra-Community acquisitions of goods subject to VAT pursuant to Article 2(1)(b) and every taxable person, or non-taxable legal person, who exercises the option under Article 3(3) of making their intra-Community acquisitions subject to VAT;

(c) any taxable person who, within their respective territories, makes intra-Community acquisitions of goods for the purposes of his transactions which fall within the activities referred to in the second subparagraph of Article 9(1) and which he carries out outside those territories;

(d) every taxable person who receives, within their respective territories, supplies of services for which he is liable to pay VAT pursuant to Article 196;

(e) any taxable person who is established within their respective territories and who, within the territory of another Member State, supplies services for which only the customer is liable to pay VAT pursuant to Article 196.

2. Member States need not identify certain taxable persons who carry out transactions on an occasional basis, as referred to in Article 12.

Sources: Article 214 of Directive 2006/112/EC

VAT shall be payable by any taxable person carrying out a taxable supply of goods or services, except where it is payable by another person in the cases referred to in Articles 194 to 199 and Article 202.

Source: Article 193 of Directive 2006/112/EC

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.