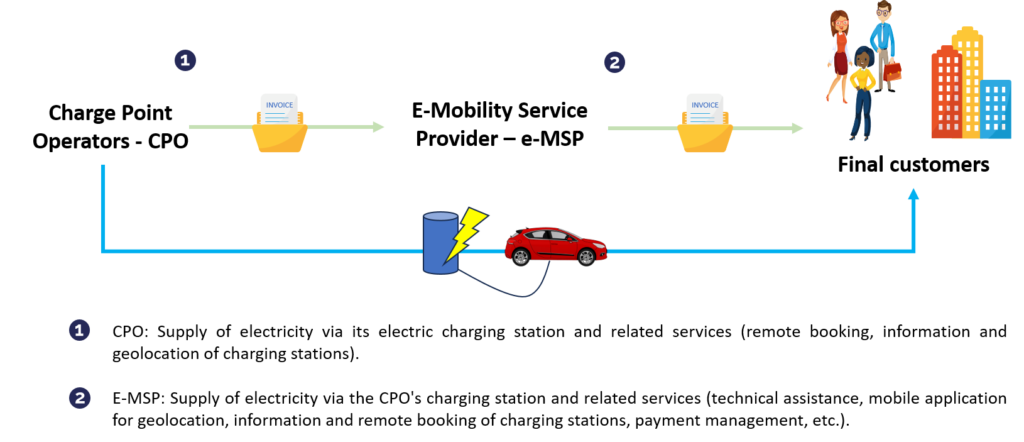

As an e-MSP (e-Mobility Service Provider) or CPO (Charge Point Operator), do you supply electricity via electric charging points and related services (consumption management, access to charging points via mobile applications)? Discover the VAT implications and ensure your compliance in all EU countries.

Electric charging stations, CPOs and e-MSPs: definitions

Electric charging stations

Electric vehicle charging stations are infrastructures available in public places (parking lots, streets) or private places (service stations, shopping centers, businesses, residences, etc.), supplying electricity to electric vehicles (EVs) or rechargeable hybrid vehicles (PHVs).

Some countries, such as Belgium, have already ruled out the fiscal nature of electric charging stations, considering them to be buildings (circular 2021/C/113 of 20/12/2021). We are awaiting feedback from the Direction de la Législation Fiscale, which is due to provide its interpretation.

Charge Point Operators (CPO)

Charge Point Operators ( CPOs ) operate electric charging stations:

- either from their own terminal park,

- or on behalf of other operators.

They install, set up, manage and maintain electric charging stations for vehicles.

In this type of contractual relationship, CPOs bill e-MSPs, not end-users.

E-mobility Service Provider (MSP)

E-mobility Service Providers, or “e-MSPs “, are mobility service providers who supply electricity via charging stations to private individuals or companies using electric vehicles. Consumers access the charging stations using cards, badges or phone applications. They offer a wide range of services: access to electric charging stations, bill and payment management, and consumer account management.

In some cases, e-MSPs can also be CPOs, with their own fleet of electric charging stations.

Transactions between e-Mobility Service Providers (e-MSPs) and end-users

E-MSPs supply electricity via charging stations to individuals and businesses using electric vehicles, as well as related services such as:

- Vehicle-specific settings ;

- technical assistance to users ;

- mobile application for remote terminal reservation, payment history, payment, etc.

The related services offered by the e-MSP are ancillary to the main operation (the supply of electricity). These services must therefore follow local VAT rules applicable to the supply of electricity.

VAT rules applicable to CPOs and e-MSPs: supply of electricity via charging stations

Operations provided by the CPO to the e-Mobility Service Provider (eMSP)

CPOs supply electricity via their electric charging stations to e-MSPs, as well as services related to electric charging (e.g. bookings, status, geolocation of charging stations, etc.).

The related services offered by CPO to e-MSPs are ancillary to the main operation (the supply of electricity). These services must therefore follow the VAT rules applicable to the supply of electricity.

Working papers n°969 and n°1012 of May 13, 2019 and the VAT Committee:

The supply of goods and services such as remote bookings, the provision of terminal information, their location or battery recharging (the main element of the operation) by a CPO is a global operation that must be analyzed as a supply of electricity within the meaning of the European directive. In its view, the only purpose of the related services is to make it easier for these vehicles to access charging stations, and therefore electricity.

Under European Directive 2006/112/EC (Article 38), the supply of electricity to a taxable dealer (e-MSP) is taxable at the latter’s place of establishment.

Consequently, if the CPO and the e-MSP are established in the same EU country, the CPO will have to charge the e-MSP the VAT of that country. On the other hand, if the e-MSP is located in another EU country, the CPO will have to invoice exclusive of VAT, and the e-MSP will have to self-assess (collect and deduct simultaneously) VAT in its own country.

Transactions between e-Mobility Service Providers (e-MSPs) and end-users

E-MSPs supply electricity via charging stations to individuals and businesses using electric vehicles, as well as related services such as:

- vehicle-specific settings ;

- technical assistance to users ;

- mobile application for remote terminal reservation, payment history, payment, etc.

The related services offered by the e-MSP are ancillary to the main operation (the supply of electricity). These services must therefore follow the VAT rules applicable to the supply of electricity.

CJEU 20/04/2023: "P.w.W." case

The CJEU has ruled out that a single, complex service consisting of access to recharging equipment for electric vehicles, supply of electricity, technical assistance to users, and the provision of IT applications enabling the end-user to book a connector, check past and current transactions, and manage payment for recharges, must be considered as a supply of goods.

Under European Directive 2006/112/EC (Article 39), electricity is taxable at the place of actual use and consumption.

There are two possibilities for VAT treatment, depending on the nature of the end customer:

The end customer is a taxable person (a company)

When the customer is a taxable person, there are three possible VAT situations:

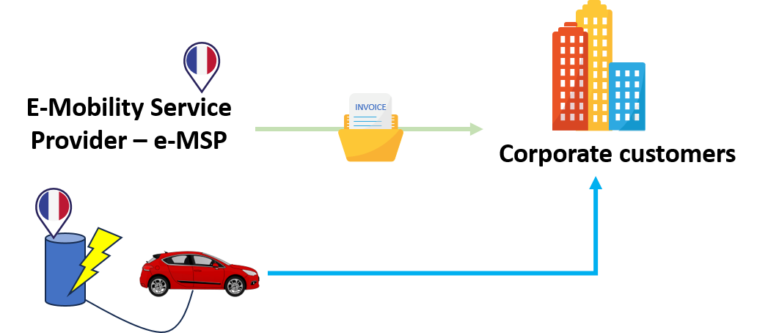

Situation 1: le-MSP and electrical terminal are in the same EU country

In such cases, the e-MSP must invoice the end customer inclusive of VAT. The e-MSP must declare and pay back the the Local Tax Office the amount of output VAT collected on sales.

Example: A French e-MSP manages an electric charging station in France on behalf of a CPO. Companies (French or foreign) buy electricity for company vehicles using electricity in France. As the electricity is actually consumed in France, the transaction is taxable in France. The e-MSP must invoice inclusive of French VAT and declare this VAT on a French VAT return.

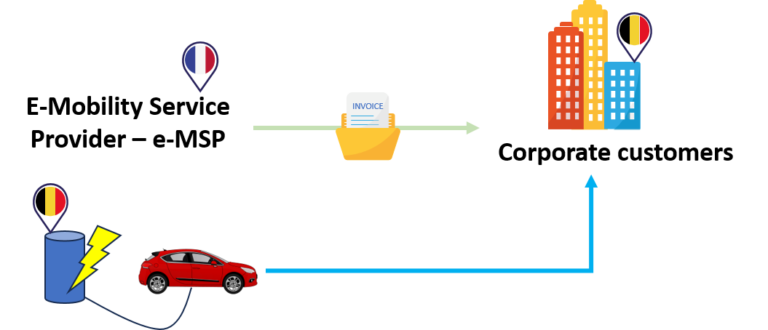

Situation 2: the e-MSP is established in a country other than that of the electrical terminal and the end customer (2 countries involved)

If the country where the terminal and the end customer are located applies the reverse charge mechanism, the e-MSP can bill the customer excluding VAT. As the end-customer is established in the country where the terminal is located, he will be able to self-assess VAT in that country on his own VAT return.

Example: A French e-MSP manages an electric charging station in Belgium on behalf of a CPO. Belgian companies buy electricity for company vehicles they charge in Belgium. As the electricity is actually consumed in Belgium, the transaction is taxable in Belgium. As Belgium has implemented the reverse charge mechanism, the e-MSP can invoice the Belgian company exclusive of VAT, which will be self-assessed at the local rate in its country.

On the other hand, if the country did not implement the reverse charge mechanism, the e-MSP will have to register for VAT purposes in the country where the terminal is located, invoice the local VAT rate of that country to its end customer and pay it to the local tax authorities. See example below.

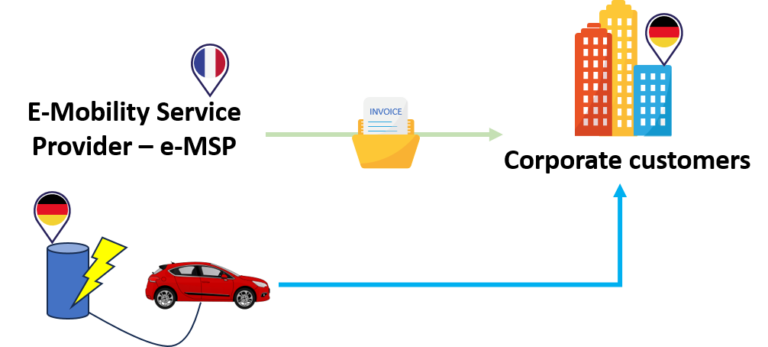

Example: A French e-MSP manages an electric charging station in Germany on behalf of a CPO. German companies buy electricity for company vehicles they charge in Germany. As the electricity is actually consumed in Germany, the transaction is taxable in Germany. As Germany has not implemented the reverse charge mechanism, the e-MSP must register for VAT purposes in Germany, invoice German VAT at the local rate, declare and pay this VAT to the local Tax Office.

Situation 3: The electrical terminal, the end customer and the e-MSP are not in the same European Union country (3 countries are involved).

The e-MSP will have to register for VAT purposesin that country, invoice its end-customer with local VAT rate, and pay amont collected to the local Tax Office.

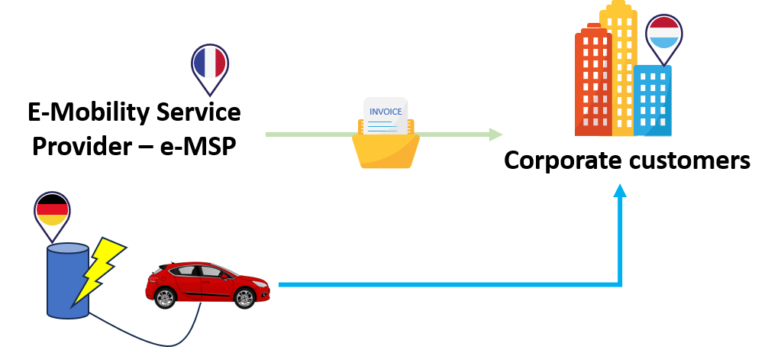

Example: A French e-MSP manages an electric charging station in Germany on behalf of a CPO. Luxembourg companies buy electricity for company vehicles they load in Germany. As the electricity is actually consumed in Germany, the transaction is taxable in Germany. The e-MSP must register for VAT purposes in Germany, charge German VAT at the local rate, declare and pay this VAT to the local tax authorities.

The end customer is a private individual.

The e-MSP must register for VAT purposes in all the countries in which it manages electric charging stations, invoice the local VAT rate for those countries, declare it and pay it to the German Tax Office.

Be careful!

E-MSPs cannot declare and pay this collected VAT via the EU OSS scheme as can do distance sellers. Why? Supplying electricity is equivalent to delivering goods. However, to declare a delivery of goods on the one-stop shop, a physical flow between two European Union countries is required, which is not the case here. It is therefore essential for e-MSPs to register for VAT purposes in all EU countries where they operate electric charging stations.

Terminal management and technical support services, including remote support by e-MSPs for CPOs

It is common practice for e-MSPs to charge CPOs for charging station management and technical support services. In isolation, these services could be considered :

- either as a land-related service : taxable where the land is located.

- or as a service falling under the general B2B rule : taxable where the CPO belongs (place of establishment)

More about us

At this stage, neither the CJEU nor the French tax authorities have ruled out on the tax status of the terminals. Some countries, such as Belgium, consider this to be land-related (circular 2021/C/113 of 20/12/2021). We are awaiting feedback from the French Tax Legislation Deparment, “Direction de la Législation Fiscale”, which is due to provide its interpretation of the nature of the terminals and related services when they are isolated from the electricity supply.