What is the best VAT/Customs treatment scheme for your e-commerce sales to the UK, with or without warehousing? Check out our scenarios and feedback.

As of January 1st, 2021, England, Wales, Scotland, Jersey and Guernsey have become non-EU countries. We offer feedback from e-sellers, and suggest new solutions for VAT and customs issues.

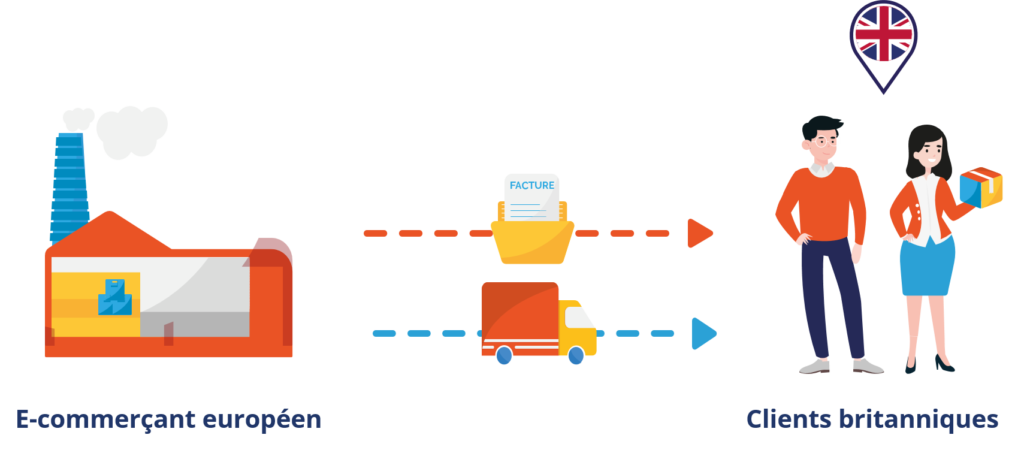

Scheme: European e-sellers sales to the UK without storage

Direct sales through their own website of parcels worth less than £135

A European e-tailer sells goods worth less than £135 through its own website to individuals in the UK.

On this transaction, the import into the UK is not subject to VAT, but the sale to UK individuals is taxable in the UK. The e-tailer must apply for an EORI-GB number to be able to import into the UK and register for VAT in the UK, in order to declare VAT on sales to private individuals established in England, Wales, Scotland, Jersey or Guernsey. The e-tailer must invoice the UK-based customer inclusive of VAT.

The EASYTAX tax representation service ensures your VAT registration and takes care of your returns.

Direct sales through their own website of parcels worth more than £135

A European e-tailer sells goods worth more than £135 through its own website to individuals in the UK.

Two options are available:

Option 1: the European e-merchant leaves the payment of the VAT to the charge of his particular customer residing in Great Britain during the customs clearance (Incoterm used other than DDP). In this case, the e-merchant does not need to identify himself for VAT purposes in the UK.

In practice: E-merchants who use option 1 face significant commercial and financial challenges .

- Some of our customers are not satisfied with having to deal with the payment of VAT at customs.

- The other part of the customers refuses the packages, which are returned to the sender at his expense!

Don’t waste any more time and adopt option 2 from the start!

Option 2: the European e-tailer takes charge of the payment of VAT at the time of customs clearance using DDP Incoterm. The e-merchant is then obliged to apply for an EORI-GB number and to register for VAT in Great Britain. The e-merchant takes care of the payment of the VAT in customs, invoices his final customers all taxes included (VAT GB included), then pays the collected VAT and deducts the import VAT on its GB VAT return.

In practice: Many e-tailers use express delivery companies to send their goods to private customers, because of their competitive prices (e.g. DHL, UPS, Fedex…).

However, this solution has its limitations:

- For each good shipped and sold, a customs import document is issued in Great Britain. It is difficult, if not impossible, for e-tailers to retrieve all customs documents from express carriers.

Please note: VAT declarations must be made in support of these customs documents and not in support of the freight forwarders’ invoices. In the event of an audit, e-traders who cannot justify imports by means of customs documents may be subject to a rejection of the right to deduct the VAT paid on importation.

- In addition, when e-merchants rely on the invoices of certain express carriers, errors are common . Indeed, some express companies compile all the operations on the same invoice (all countries of destination included). Therefore, when analyzing the invoices, import customs in countries other than Great Britain (China, USA, etc.) should be deducted.

- Other problems are encountered, such as freight forwarders who demand payment of VAT at customs from end customers, even though the end customer has been invoiced VAT included. This leads to double taxation.

- In other cases, express carriers may mistakenly list the end customer as the importer. In the event of an audit, this error may lead to a rejection of the deductibility of import VAT for the e-merchant who is not able to justify that he acted as an importer.

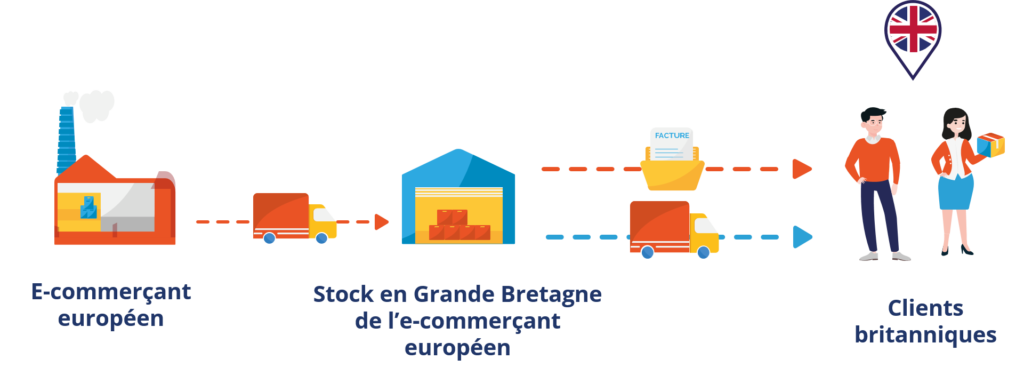

Scheme: European e-tailers selling in the UK with warehousing

Direct sales through their own website

A European e-seller stores goods in Great Britain.

The e-merchant must register for VAT in the UK and obtain an EORI-GB number to clear the goods through customs in the UK.

- For parcels under £135, no import VAT will be due but the e-tailer must collect UK VAT which must be declared and paid to the UK Administration.

- For parcels valued over £135, import VAT is due and can be deducted on the UK VAT return. The e-merchant must collect British VAT which must be declared and paid to the British Administration.

In practice:

The establishment of a stock in Great Britain is recommended in the case where the e-merchant himself uses suppliers established in countries other than Great Britain.

Indeed, if the e-tailer does not set up stock in England, Scotland, Wales, Jersey or Guernsey, he will have to pay import duties, if the goods are subject to them, when storing in France.Scotland, Wales, Jersey or Guernsey, he will have to pay import duties, if the goods are subject to them, when storing them in France, and pay them again when sending them to customers in Great Britain.

On the other hand, if the e-merchant sets up a storage in Great BritainIn addition, the company can ask its suppliers to deliver the stock directly to the UK and save on logistical costs and, above all, on customs duties. The e-tailer will also reduce its delivery times to its UK customers.

For all questions relating to importing following the Brexit, find our article on the subject: Brexit & e-commerce: how to import from England and Great Britain.

EASYTAX helps you to set up practical and secure solutions with, in particular, global groupage solutions integrating logistical, fiscal and customs aspects. These grouping solutions make it possible to carry out a single import for several end customers and then to deliver, after import, to each of its customers.