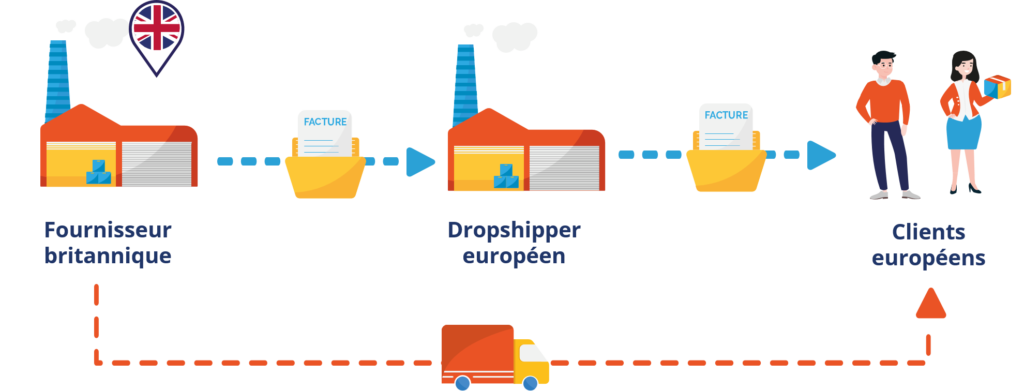

What European e-sellers need to know, post-Brexit, about the VAT implications of their dropshipping operations from the UK to the EU.

As of January 1st, 2021, England, Wales, Scotland, Jersey and Guernsey have become non-EU countries . A year and a half later, we’d like to give you some feedback and suggest some new solutions to the VAT issues encountered when dropshipping from the UK.

dropshipping scheme for European e-tailers from the UK

Direct sales through their own website of packages worth less than 150€.

The operation is subject to an import VAT exemption. On the other hand, the e-merchant must invoice his customer including VAT in the country of the purchaser.

The e-merchant must register with IOSS (Import One Stop Shop) in his country of establishment, declare and pay the VAT collected at the rate applicable in the various countries where he sells.

Direct sales through their own website of packages worth more than 150€.

The e-seller must register for VAT in the buyer’s country. He must then pay import VAT and invoice the end customer inclusive of VAT in the purchaser’s country.

The e-merchant can deduct the import VAT and pay back the collected VAT via his VAT number and his local VAT return.

Sales through a marketplace of packages worth less than 150€.

The operation is subject to an import VAT exemption. On the other hand, the e-merchant must invoice his customer including VAT in the country of the purchaser.

VAT is collected, declared and remitted by the marketplace through its own IOSS portal.

Sales through a marketplace of packages worth more than 150€.

The e-merchant must register for VAT in the buyer’s country. He must then pay the import VAT and invoice the final customer including VAT.

The e-merchant can deduct the import VAT and pay back the collected VAT via his VAT number and his local VAT return.

In practice

E-merchants who make both sales below and above 150 euros via a marketplace must be careful to distinguish between the two types of operations, which have different applicable VAT regimes.

In fact, e-tailers often treat the two types of transaction in the same way, and pay VAT to the authorities regardless of the value of the parcel.

However, below 150 euros per package, it is up to the marketplace to pay the VAT. If the e-merchant also pays VAT on the same transaction, there will be double taxation.

In practice

Whether you need occasional assistance via a VAT hotline or a regulatory note, management of your OSS/IOSS VAT one-stop-shops or VAT tax representation in Europe, our experts are ready to support you: contact us!

For all questions relating to importing following the Brexit, find our article on the subject: Brexit & e-commerce: how to import from England and Great Britain.