It can be tricky for a foreign company that are not established in France to ensure VAT compliance, especially for operations whose recurrence or nature would make VAT registration in France an administrative and financial burden. There is a less restrictive solution than using a traditional tax representative.

On January 1ᵉʳ, 2025, Decree 2025-153 came into force , abolishing the punctual tax representation regime, now replaced by the punctual tax agent (MFP) regime. No need to panic for foreign operators who previously benefited from the old system: an exceptional extension published by the administration in a rescrit allows operators to retain the temporary use of a punctual tax representation for the time needed to make the transition to a classic tax representation or to the new punctual tax agent system when the conditions are met until December 31, 2025. You can also call on VAT regulatory assistance to help you choose the best arrangement.

What is an “Occasional Fiscal Representative”?

The occasional fiscal representative is a legal entity appointed to temporarily fulfill, in the name and on behalf of a foreign company, certain specific VAT obligations in France.

The occasional fiscal representative is distinguished by its targeted nature: its intervention is limited in time and purpose. The one-off, controlled nature of these operations simplifies VAT management, while ensuring good traceability with regard to the authorities.

Unlike the “classic” tax representative, the one-off agent is not jointly and severally liable for the tax debt. The legal and fiscal responsibility remains entirely with the principal company, which limits the risks for the agent while ensuring a degree of flexibility for foreign companies.

Who can use it and in what situations?

This new, more flexible and extended occasional fiscal representative scheme is available to companies that are not established or identified for VAT purposes in France.

The decree of February 18, 2025 clarifies the scope of the occasional fiscal representative scheme, which has been extended to cover not only imports for which VAT is fully deductible, but also :

- Exports and similar deliveries ;

- Operations under suspensive customs and tax regimes followed by exports of goods ;

- Imports that have been the subject of one or more deliveries under the same schemes.

However, a distinction must be made between companies established in another Member State and those established outside the European Community. Indeed, a company established in the EU which carries out only imports (under customs regime 42) immediately followed by an exempt intra-Community delivery may, by application of article 95 b of the CGI, benefit from the use of a one-off tax agent and the advantages that go with it (example 1).

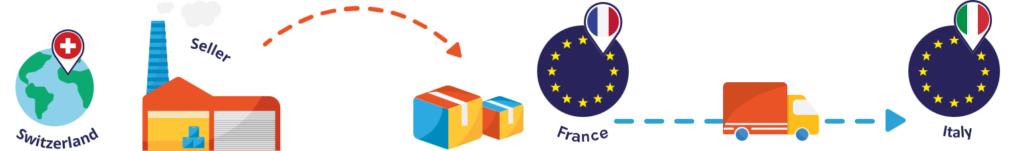

An Italian operator imports goods from Switzerland and sends them to France:

Example 1:

An import followed immediately by an exempt intra-Community delivery, allowing the use of an MFP in accordance with article 262 of the CGI and referred to in article 95b of the CGI.

However, this is no longer the case for operators established outside the European Community, who must now subscribe to a classic tax representation. They can still benefit from the MFP scheme, but no longer for imports under the 42 regime.

The MFP remains an opportunity for these operators to avoid having to register in France when the goods to which the operations relate are entrusted in France under a contract of sale on consignment, workmanship, assembly, hire or warehousing, or under a contract ensuring the transit of goods to a territory other than France, as defined by article 289 A bis of the CGI. Followed by export to the country of departure (example 2) or to a non-EU country.

A Swiss trader exports goods to France as part of a processing operation, which are immediately :

Example 2:

An export of goods under article 262 I-2° of the CGI allows the operator to designate an MFP without registering in France, in order to meet his import tax obligations under the new article 95 ter of the CGI.

What are the advantages of using the services of a temporary tax agent?

The use of a one-off fiscal agent is of major strategic interest to foreign companies carrying out low-recurrence operations in France, while being exempted from VAT registration, rather than having to go through the cumbersome process of VAT registration or appointing a conventional fiscal representative. Using an MFP enables you to :

- Benefit from a VAT exemption (e.g.: imports followed by an intra-Community delivery) without registering for French VAT;

- Secure the transaction with a strict contractual framework for the mandate;

- Preserve tax liability for the foreign taxpayer alone, alleviating the risks for the agent.

The occasional fiscal representative scheme also responds to the problem raised by the Weindel Logistik ruling. Weindel Logistik ruling by the Court of Justice of the European Union (CJEU).

In this case, the CJEU ruled that the right to deduct import VAT could not be granted to an importer who is not the owner of the goods and whose import costs are not directly linked to its economic operations. This means that the manufacturer can declare and deduct import VAT on behalf of his customer, while avoiding the tax risks associated with the absence of a right to deduct.

The new occasional fiscal representative scheme offers a suitable solution to this problem, and also means that you don’t have to register for VAT in France, so you don’t have to use a suspensive tax regime or a customs regime such as inward processing.