It is not always straightforward for a foreign company to ensure VAT compliance for transactions that will only occur from time to time with its European counterparts. When facing such a situation, companies do not want to trigger complex VAT obligations. Instead of registering for VAT purposes, companies can now benefit from a less restrictive solution through a Limited Tax Agent scheme. This article will highlight transactions covered by this simplified scheme as well as its advantages rather than appointing a standard fiscal representative.

On January 1st, 2025, a decree came into force, abolishing the existing Limited Tax Representative scheme, replacing it with a Limited Tax Agent (LTA) scheme. Foreign companies that used to benefit from the former scheme are still allowed to do so for a transitional period until the end of the year. By the end of December 2025, those companies must have taken necessary measures to ensure VAT compliance. Two options are available to them :

- Register for VAT purposes in France to handle all transactions ;

- Appoint a Limited Tax Agent if eligible to use that scheme.

Easytax can assist companies from the beginning through our VAT regulatory assistance by confirming which solution is better suited.

What is a “Limited Tax Agent”?

A Limited Tax Agent is a legal entity temporarily appointed by a foreign company to handle VAT obligations on its behalf. The main difference with a standard fiscal representative is that the foreign entity can use the Limited Tax Agent’s VAT number instead of having its own. This significantly reduces the administrative burden bearing on the foreign company.

What also sets this Tax Agent apart is the targeted nature of its role : its involvement is strictly limited in time and scope, focusing only on specific transactions that we will detail in the next paragraph.

Unlike a regular fiscal representative, the Limited Tax Agent is not jointly and severally liable for any VAT nor Customs debt. The legal and fiscal responsibility stays entirely with the foreign company, which reduces risks for the Tax Agent while offering a greater level of flexibility for foreign companies operating in France and potentially within the European Union.

Scope of the Limited Tax Agent’s scheme

This new, more flexible and extended Limited Tax Agent’s scheme is available to companies that are not established or identified for VAT purposes in France.

The decree of February 18, 2025 also clarifies transactions covered by the newly implemented scheme:

- Imports of goods into France for which VAT is fully deductible;

- Imports of goods into France followed by subsequent intra-Community supply of goods to another EU Member state ;

- Exports of goods from France to a non-EU country ;

- Transactions under Customs and Tax suspension schemes followed by exports of goods to non-EU countries.

When talking about the scope of this newly reformed Limited Tax Agent scheme, it is important to make a distinction between companies established in another Member State and companies established outside of the European Union.

Until now, the former Limited Fiscal Representation scheme was mainly used to import goods into France with an onward supply to a business customer located in another EU Member State. For Customs purposes, this transaction is often referred as “Procedure 42” or “Onward Supply Relief” scheme. This avoids having to pay VAT in the country of import by postponing the VAT settlement in the country of arrival. The advantage of using a Procedure 42 is that VAT is settled through an Intra-Community acquisition of goods without having to actually pay VAT (VAT is being reverse charged in the country of arrival). The below example illustrates how the Procedure 42 can be used.

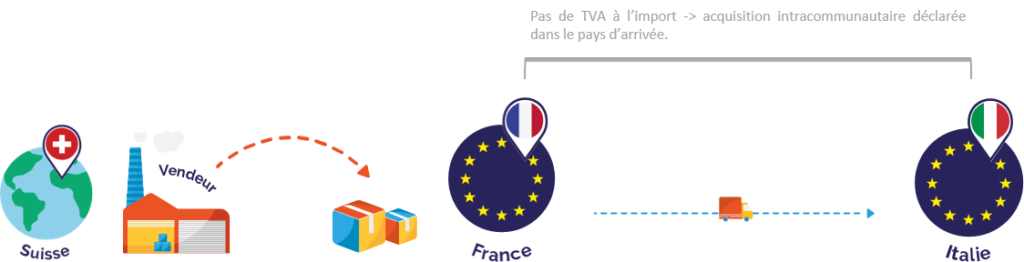

1st example: an Italian company imports goods from Switzerland to France for onward supply to Italy using a Procedure 42:

As the transaction is carried out by an Italian company, the latter can appoint a one-off tax agent in France to carry out customs clearance via a 42 system, and then ship the goods to Italy. In this way, it avoids paying import VAT, which would have been the case had the goods been cleared directly in Italy.

While this option is still available to EU based companies, it is no longer possible for a company based outside of the EU to carry out this type of transaction using a Procedure 42. However, thanks to the newly reformed Limited Tax Agent’s scheme as well as the mandatory use of postponement of import VAT in France , the non-EU company will be able to reach the same level of flexibility without having to register for VAT purposes.

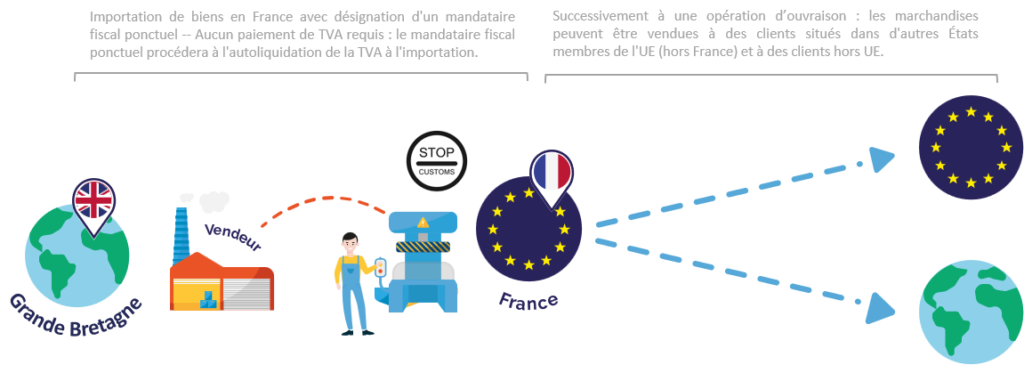

2nd example: a UK company has a tolling manufacturer based in France. Goods are shipped from the UK to France. Once manufactured, goods are sold to clients based within the EU but also to non-EU clients.

The UK company is now able to send goods to a tolling manufacturer in France without the need to register for VAT purposes. The Limited Tax Agent is able to reverse charge the amount of import VAT to avoid any impact on the UK company’s cash flow. .

This example highlights the diversity of transactions covered by the new Limited Tax Agent’s scheme. To summarise, non-EU companies can use this method to:

- Import goods into France followed by a subsequent Intra-Community supply of goods to another EU Member state. The previous example mentioned that the onward supply relief scheme can no longer apply. While this is true, the same goal can be achieved using a standard Customs regime called “Release to free circulation” (Procedure 40) together with the appointment of a Limited Tax Agent ;

- Import of goods into France for tolling services followed by either Intra-Community supply of goods to another EU Member state or by exports of goods to a non-EU location ;

- Import of goods intro France followed by exports of goods to a non-EU location.

The Limited Tax Agent’s scheme also offers a great alternative to the issue raised by the CJEU Weindel Logistik tax ruling.

As a reminder, the CJEU ruled that the right to deduct import VAT could not be granted to an importer of record who does not own the goods that are being imported. This also applies if VAT is reverse charged; the importer of record is not able to deduct import VAT resulting in a payment of import VAT without any possibility of reclaiming this amount.

With the appointment of a Limited Tax Agent, a foreign company can import goods and ship them to its manufacturer in France without triggering heavy VAT obligations nor taking any financial risks. If the manufacturer is registered as a Limited Tax Agent, import VAT will be settled without any risks.

This solution can be a great alternative to other suspension schemes, such as a Customs Inward Processing scheme for instance, that are usually heavier to implement.

Why choosing to appoint a Limited Tax Agent?

Appointing a Limited Tax Agent offers significant advantages for non-EU businesses that only carry out occasional taxable transactions in France and within the EU. First and foremost, the Limited Tax Agent scheme allows eligible foreign companies to avoid a full VAT registration, thereby reducing administrative complexity and long-term compliance obligations. Instead of obtaining their own French VAT number, companies can use the VAT number of their appointed Limited Tax Agent, which simplifies interactions with the French Tax Authorities.

Another major benefit is that the Limited Tax Agent is not jointly and severally liable for VAT or customs debts, meaning the legal responsibility remains solely with the foreign company. This feature reduces the risk for the agent and makes it easier to find a service provider willing to act in this role — compared to a full fiscal representative arrangement, which involves much stricter liability, potential bank guarantees and so on.

In addition, the new scheme covers a broader range of transactions than before, including imports followed by intra-EU deliveries or exports of goods. Combined with the mandatory use of postponed import VAT accounting in France, the Limited Tax Agent scheme enables companies to maintain fluid supply chains and benefit from flexible customs procedures like Procedure 40, without needing to settle VAT upfront.

In short, the Limited Tax Agent scheme provides a tailored, lower-friction alternative for businesses seeking VAT compliance in France — without the administrative weight of a permanent VAT presence.

More about us

To find out more about the conditions governing the right to deduct VAT on imports for French packers/manufacturers, see our blog dedicated to the CJEU Weindel Logistik ruling.