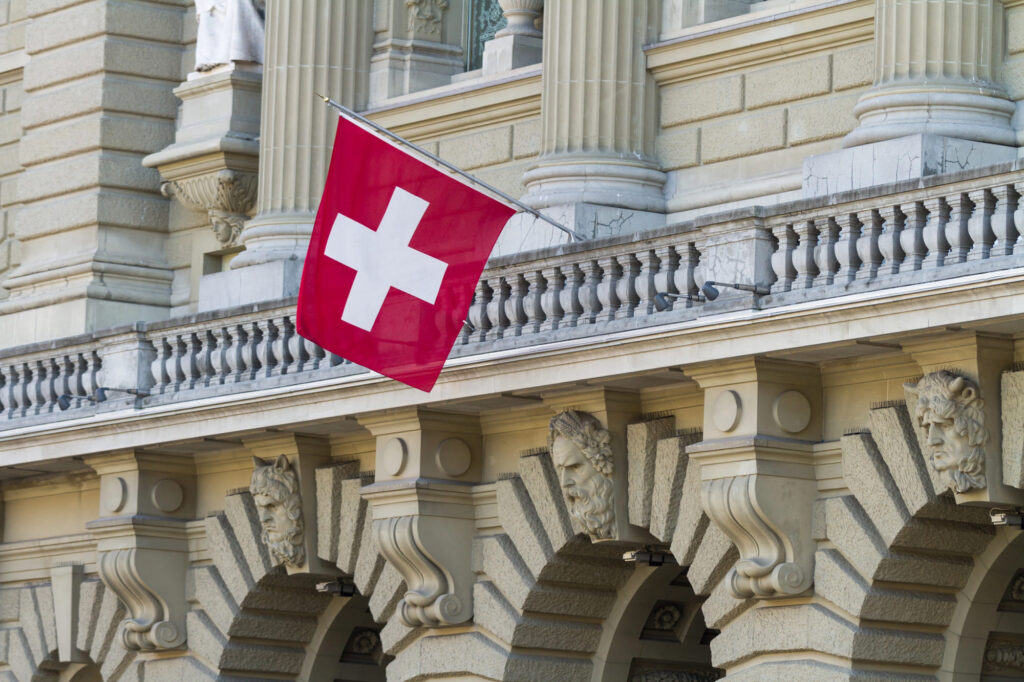

E-commerce in Switzerland: Major VAT regulation changes starting January 2025

As per its European neighbours, Switzerland is intensifying its efforts to fight against VAT fraud, especially in the e-commerce industry. Starting from January 2025, new regulations will be implemented with two main objectives: making marketplaces more accountable for the VAT collection and ensuring a level playing field for both local and foreign companies selling in…

EORI number for your import and export operations

An EORI number is essential for any company importing or exporting from the European Union, in order to carry out the necessary customs procedures.

Electric charging points: VAT for CPOs and e-MSPs

Are you an e-MSP or CPO supplying electricity via electric charging stations or related services ? Discover the VAT implications and ensure your compliance in all EU countries.

When to appoint a fiscal representative in Europe (EU)?

Appointing a fiscal representative is not always a requirement within the EU, but it is always a good idea: find out why.

VAT and dropshipping from the UK to the EU

What European e-sellers need to know, post-Brexit, about the VAT implications of their dropshipping operations from the UK to the EU.

VAT rates in Europe: what will change in 2023

The structure of VAT rates, partially harmonized within the European Union, will evolve, and the list of products that can benefit from reduced rates as well: this is what the Directive of April 5, 2022 defines for application before the end of 2024 / early 2030.

DEB / INTRASTAT become EMEBI in 2022

Are you a foreighn company importing goods into France? If so, from 2022 onwards, you must have a French VAT number and use the reverse charge mechanism on the French VAT return (CA3).

Reverse charge mechanism: importers into France must obtain a French VAT number from 2022

Are you a company not established in France that imports goods into France? If so, from 2022 onwards, you must have a French VAT number and use the reverse charge mechanism on the French VAT return (CA3).